Members of the Canadian Armed Forces (CAF) as well as police officers who are deployed on international high and moderate-risk missions can receive tax relief from the Government of Canada.

Eligible CAF members and police officers may claim a deductible against their taxable income earned while being deployed on such missions abroad.

“This tax relief recognizes the special contribution that CAF and members and police officers make to international peace and stability while serving their country abroad,” a statement from Department of Finance Canada said.

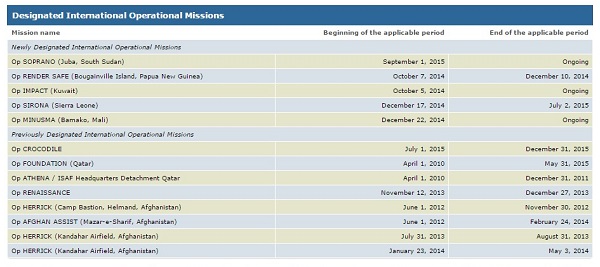

On February 16, the Minister of Finance added the following moderate-risk missions to the previous list of designated missions for tax relief:

The maximum amount that an individual may deduct in a taxation year cannot exceed the highest level of pay earned by a non-commissioned member of the CAF.

For personnel deployed on high-risk missions, such as missions assessed by the Department of National Defence as carrying a risk score between 2.50 and 4.00, tax relief is automatically provided for the period over which the mission is assessed as being high-risk.

For moderate-risk missions, such as missions carrying a risk score between 2.00 and 2.49, tax relief is provided when the mission has been designated by the Minister of Finance, and for the period over which the mission is assessed as being moderate-risk.

For national security reasons, classified missions that are designated are not listed. For such missions, the DND and/or Public Safety Canada are responsible for contacting eligible CAF members and police officers.

Prior to June 2013, moderate-risk missions qualified for tax relief when approved by Cabinet and prescribed in the Income Tax Regulations.